e-Invoicing and e-Tax Compliance in Africa

In recent years, the vast majority of African countries have initiated plans for the digital transition of their administrations.The implementation of e-Invoicing and Electronic VAT Reporting systems stands out among the measures undertaken by the different governments. We analyze the current state of e-Invoicing in Africa and the new obligations of Electronic VAT Reporting.

Index [Hide]

- E-Invoicing Drives Digital Transformation in Africa

- e-Invoicing Systems in Africa

- Virtual Fiscal Devices

- e-Filing en Africa

- e-Invoicing and Tax Compliance in North Africa

- e-Invoicing and Tax Compliance in West Africa

- e-Invoicing and Tax Compliance in Central Africa

- e-Invoicing and Tax Compliance in East Africa

- e-Invoicing and Tax Compliance in South Africa

- How to e-Invoice in Africa

e-Invoicing Drives Digital Transformation in Africa

Africa is undergoing a digital transformation of its economy. In recent years, several initiatives have been undertaken at the national, regional, and continental levels to improve the continent's different tax systems through new technologies.

One of the most important initiatives is the African Union's Agenda 2063: The Africa We Want."AGENDA 2063 is Africa's blueprint and master plan for transforming Africa into the global powerhouse of the future."Agenda 2063. African Union Commission.

It is a vast strategic framework that, among its objectives, includes,

building efficient, transparent, and streamlined tax and revenue collection and public expenditure systems, improving domestic savings and eliminating all forms of illicit flows.

Following the roadmap set by Agenda 2063, the Africa Initiative and Smart Africa projects stand out.The Africa Initiative is designed to develop the exchange of tax and accounting information electronically across the continent. Smart Africa, meanwhile, aims to create a single digital market in Africa and accelerate the continent's sustainable socioeconomic development through the use of ICTs.

In practice, these initiatives have resulted in many African countries opting to digitize their tax systems through the imposition of e-Invoicing or Electronic VAT Reporting methods in recent years.

This is due to the fact that Electronic VAT Reporting makes it possible to essentially comply with all the objectives established by Agenda 2063 in economic terms:

- Tax control facilitation. Authorities have real-time access to tax and accounting information, helping to reduce tax fraud.

- Improved traceability of electronic transactions, helping to reduce the informal economy.

- Tax compliance simplification. Everything is done in an automated and immediate way, helping to reduce tax evasion.

- Increased tax collection, resulting in improved domestic savings and less external dependence.

- Improved competitiveness of companies by reducing management costs and human error.

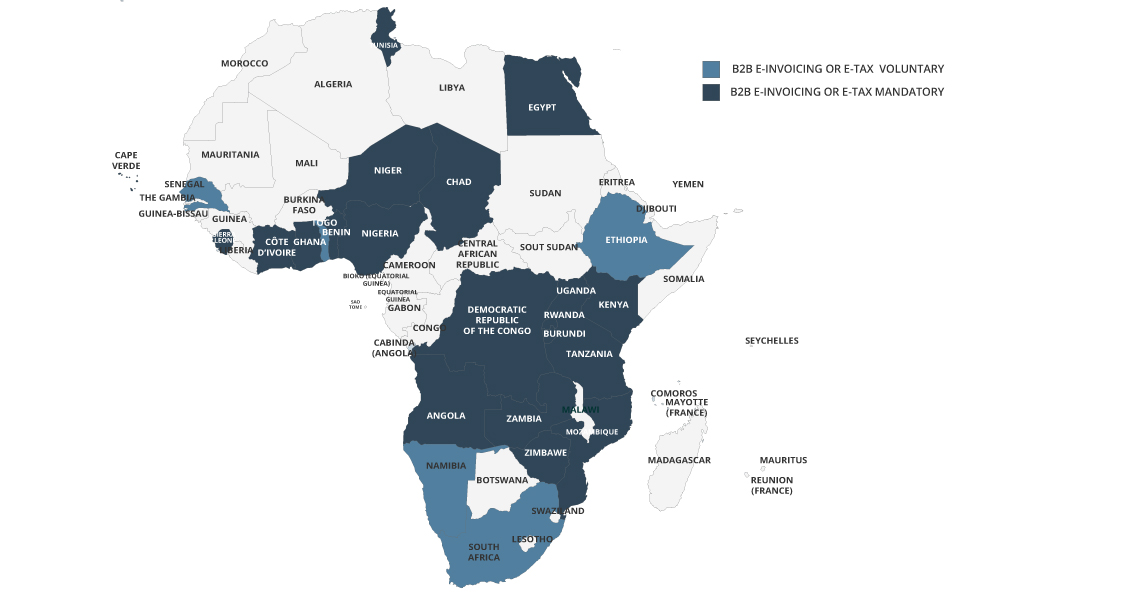

All these advantages have led 19 countries to make the electronic exchange of tax documents mandatory, 11 of them in 2022. And another 5 voluntarily, totaling almost half of the countries that make up the continent.

e-Invoicing Systems in Africa

Despite efforts to promote the pan-African union and for Africa to become a single market, as is the case in other markets such as Asia or Latin America, each country has decided to develop its own electronic auditing systems. In other words, there is no existing continent-wide legislation standardizing the use of e-Invoicing. Hence, we find different types of e-TAX compliance according to the needs of each country.

Therefore, although there is no standardized e-Invoicing model or continental network, such as PEPPOL in Europe, that facilitates the exchange between companies and government, there is a predominant implementation model throughout Africa, the Virtual Fiscal Device system.

Virtual Fiscal Devices

Virtual Fiscal Devices are electronic systems connected to tax authorities to send e-Invoices. Generally speaking, companies generate their e-Tax reports through their e-Invoicing software and send them to the competent tax authority through the VFD. It is an evolution of Electronic Fiscal Devices, physical devices connected to cash registers to send invoices in real time to the tax authorities in the B2C field. Uganda, Zambia, Tanzania, Chad, Rwanda, and Benin are some of the countries that have opted to use VFDs.

e-Filing in Africa

Another common element of e-Procurement in Africa has been e-Filing platforms. Due to the difficulties of many countries in expanding broadband and developing a robust telecommunications infrastructure to enable businesses to automate data exchange, almost all African countries have made electronic e-Filing portals available to taxpayers. Through these platforms, taxpayers can manually upload their e-Documents without having to go to the tax offices of each Treasury. In many cases, e-Filing portals have evolved to become the tax authority hub, enabling the integration of communications between businesses and government. It is the first step toward paperless administrations and helps lay the groundwork for an integrated communication model.

e-Invoicing and Tax Compliance in North Africa [Hide]

e-Invoicing and Tax Compliance in North Africa

However, of the five North African countries, only two, Tunisia and Egypt, have developed e-Invoicing systems. The fact that they were the first Arab countries to require its use has served as an example for others who have begun to follow in their footsteps, such as Saudi Arabia, Oman, and Jordan.

Tunisia

Tunisia is one of the African and Arab countries that has made the most significant commitment to digitalization. The government has undertaken numerous initiatives to optimize fiscal and administrative processes thanks to the use of new technologies. Among the initiatives, the mandatory implementation of the e-Invoicing system called fatoura stands out.Since 2016, its use has been mandatory in B2G and the private sector for large companies, making it the first Arab country to impose e-Invoicing.

Egypt

Egypt has also embraced e-Invoicing to drive the digital transformation of government and businesses. In the case of the Egyptian Tax Authority – ETA, it has opted to make its use mandatory for all private and public companies in the country after 2 years of staggered implementation. Egypt has chosen a methodology very similar to that used by many Latin American countries, which are world leaders in e-Invoicing.

e-Invoicing and Tax Compliance in West Africa [Hide]

e-Invoicing and Tax Compliance in West Africa

Half of the countries that make up the West African subregion have undertaken measures for Electronic VAT Reporting, and it should be noted that many of the systems in place require the use of digital certificates or e-Tax stamps.

Benin

The e-Invoice is called facture normalisée and was introduced on a mandatory basis in 2020 for all businesses subject to VAT. Companies must send e-Invoices to the system Système dématérialisé des Machines Électroniques Certifiées de Facturation (e-MECeF). For them, the measure was taken by the Direction Générale des Impôts - DGI as part of the modernization of the tax system.

Cape Verde

As part of the Digital Tax and Customs Reform ++, the Direçao Nacional de Receitas do Estado – DNRE, has imposed the gradual use of e-Invoicing, ending the massification in June 2022 with the joining of the last group of taxpayers.

Côte d'Ivoire

In 2019, the Direction Générale des Impôts – DGI, Côte d'Ivoire's tax authority, within the Plan National de Développement – PND, National Development Plan, implemented a new certified e-Invoicing system, which imposes the real-time sending of electronic and stamped invoices to the DGI. For the time being, the obligation only affects technology companies offering digital goods or services.

The new tax model aims to modernize the tax system and improve the traceability of electronic transactions.

Togo

In the case of the Togolese Republic, the e-Invoice was equated to the paper invoice in 2018, and its use is voluntary.

Niger

Niger has opted for an e-Invoicing system very similar to that of neighboring Benin. The invoicing system is called Le Système Électronique Certifié de Facturation (SECeF), and the e-Invoice is also called a certified invoice. Its use has been mandatory for all companies since 2021. With its implementation, the Direction Générale des Impôts – DGI aims to facilitate increased tax collection, improve tax compliance, facilitate companies’ management, and enhance their competitiveness.

Nigeria

Nigeria is in the process of developing its tax and accounting reform project, “Integrated Tax Administration System – ITAS,” with which the tax authority, Federal Inland Revenue, wants to automate tax management in the country. It is an e-VAT Compliance system through which all taxpayers must report their transactions electronically. In addition to e-Reporting, companies must, as of February 2022, send all import and export invoices electronically to the Central Bank of Nigeria (CBN).

Senegal

Senegal is one of the first African countries to equate the validity of e-Invoices with paper invoices. It did so in 2008 through the Law – loi n° 2008-08. For the time being, its use remains voluntary. However, at the e-VAT level, the Direction générale des Impôts obliges all taxpayers to report their financial activity through the government platform “Sen-etafi” as of 2021.

Ghana

Ghana began from the 1st of October 2022 the rollout of their certified electronic invoicing system. The implementation is taking place in waves, starting with the 600 largest taxpayers that generate more than 90 per cent of VAT revenue. Wave two will be the medium-sized taxpayers, which will start in 2023. And by 2024 all businesses need to be linked to the Government Portal issuing certified “e-VAT invoices”.

e-Invoicing and Tax Compliance in Central Africa [Hide]

e-Invoicing and Tax Compliance in Central Africa

The central zone of the continent also shows changes in tax compliance. Interestingly, Angola is the only country outside the European Union where the OECD standard, SAF-T, is used to report companies’ tax and accounting information in the country.

Angola

Angola is the only country outside Europe to have adopted the SAF-T requirements for electronic data transmission relating to VAT reporting and accounting elements. Since 2019, the Adminitraçao Geral Tributária – AGT, has collected information from selected taxpayers through the OECD system.

Chad

As of January 2022, VAT reports will be submitted electronically to the tax authorities via email.

Zambia

It follows in the footsteps of other African countries such as Uganda, Tanzania, and Benin. The Zambia Revenue Authority requires all businesses subject to VAT to issue e-Invoices using Electronic Fiscal Devices (EFD) in B2B and B2C environments.

The Democratic Republic of the Congo

The Directorate General of Taxes (DGI) of the Democratic Republic of the Congo has recently announced that it will require Electronic VAT Reporting for all taxpayers subject to VAT. Implementation will be gradual, starting with large companies, with prior notice from the government.

e-Invoicing and Tax Compliance in East Africa [Hide]

e-Invoicing and Tax Compliance in East Africa

Among the East African countries, Kenya, Uganda, and Tanzania are the ones that have presented the most legislative developments in terms of e-Tax compliance in recent years. In addition, Kenya, along with Senegal and South Africa, is one of the first countries to favor e-Tax in Africa.

Burundi

The e-Invoice is part of the set of reforms aimed at the control and traceability of trade by the tax authority of the Office Burundais des Recettes – OBR. In fact, the law requires that, as of 2022, companies subject to VAT and foreign companies with a local tax representative declare invoicing data related to transactions and payments in real time. However, e-Tax compliance is being limited by the state of digitalization of companies.

Kenya

Since 2005, several initiatives have been undertaken by the Kenyan Treasury, Kenya Revenue Authority – KRA, to digitize the government's administrative processes. In fact, taxpayers have at their disposal several digital platforms to carry out transactions telematically. However, the definitive step has been taken in 2022 with the massification of e-Invoicing. As of November 30th, all businesses subject to VAT must report their e-Invoices to the government through the Tax Invoice Management System – TIMS.

Tanzania

Tanzania is another African country that has opted for a VAT compliance system based on Electronic VAT Reporting through fiscal devices, Virtual Fiscal Device (VFD). Taxpayers must declare their e-Invoices to the tax authorities, Tanzanian Revenue Authority – TRA, for B2B and B2C in real time.

Uganda

The Uganda Revenue Authority, URA, has imposed, as of January 2022, e-Invoicing on all taxpayers. The invoicing system, called EFRIS (Electronic Fiscal Receipting and Invoicing System), impacts both the B2B2G and B2C sectors. Companies must send e-Invoices to EFRIS through electronic fiscal devices (EFDs).

Rwanda

As of 2022, the only valid way to invoice in Rwanda is through the government's new certified invoicing system. E-Invoices must be issued through electronic fiscal devices called Electronic Billing Machines. It is one of the most important measures undertaken by the Rwanda Revenue Authority to combat the informal economy.

e-Invoicing and Tax Compliance in South Africa [Hide]

e-Invoicing and Tax Compliance in South Africa

Except for South Africa, where the use of e-Invoicing is widespread, the rest of the countries in the southern region are in the process of a digital transition. Some countries, such as Zambia or Zimbabwe, have opted for using EFDs, while others are creating e-Filing portals to facilitate taxpayer reporting.

South Africa

Although e-Invoicing is voluntary, its use is widespread in the country. In fact, it is one of the pioneer African countries to introduce its use. To exchange e-Invoices in an integrated manner through Electronic Data Interchange, prior approval from the Treasury of South Africa, The South African Revenue Service – SARS, is required. In addition, SARS has defined what the e-Invoice should look like and the conditions for its e-Archiving.

Zimbabwe

Following the example of other African countries, as of January 2022, Zimbabwe requires the declaration of e-Invoices through e-Tax devices, Electronic Tax Registers. ETRs send real-time transaction information from taxpayers to the tax agency ZIMRA.

Lesotho

The government plans to introduce electronic B2B2G and B2C invoicing. Right now, we are waiting for the Revenue Services Lesotho - RSL tax authority to define the model.

How to e-Invoice in Africa

As we have seen, Africa is in the process of e-Invoicing and e-Tax compliance expansion. The tax compliance calendar changes daily, and operating according to the new requirements is challenging. EDICOM's Global Compliance platform is prepared to help companies with a presence on the continent to exchange any e-Documents they may require, complying with all the requirements demanded by each administration. Thanks to EDICOM's e-Invoicing Observatory, all our services are constantly updated and adapted to the latest developments worldwide, ensuring that your company runs smoothly at all times wherever you need to do business.

EDICOM also has an office in Morocco, created as a center of operations in Africa and the Middle East, to help multinational companies develop their businesses in the region.