EDICOM PDP candidate for Electronic Invoicing in France

The registration service for dematerialization platforms is already examining the first applications.

Registration involves a detailed analysis of the capabilities and guarantees of the service providers applying to offer e-invoice sending and receiving services, as well as the declaration of e-Reporting flows.

EDICOM is on the initial list of operators applying to become PDPs published by the Direction générale des Finances publiques (DGFiP).

During the Communauté des relais event, the DGFiP and AIFE announced that a forthcoming decree, expected in the second quarter of 2024, will enable the registration of PDPs, contingent on the availability of the PPF.

Initial official registrations for PDPs are scheduled for July 2024.

Accreditation as a PDP for Electronic Invoicing will make EDICOM one of the most comprehensive partners to provide services for the issuance and receipt of electronic invoices according to the French system. This is a system for which our company already has operational solutions, thanks to the experience gained since 1995 not only in France. In fact, we are the provider of electronic invoicing and e-Reporting solutions for some of the world's largest companies in more than 70 countries worldwide where EDICOM operates.

Table of Contents: [Hide]

Companies will be able to manage their electronic invoices in France through PDPs (Partner Dematerialization Platform).

These platforms will act as accredited third parties by the DGFiP (Directorate General of Public Finance) for the validation of invoices, their submission to the hub that the French government has implemented to centralize invoice distribution in the country (referring to the PPF or Portail Public de Facturation), as well as delivering them to the recipient when they also use the services of another PDP.

Partners aspiring to become PDPs must be accredited by the Directorate General of Public Finance of France (DGFiP). PDPs that successfully complete this process will have thus demonstrated that the provision of their service complies with the required information security requirements. This process also confirms the PDP's ability to interoperate with other accredited partners.

The selection of one PDP or another will be conditioned by factors such as their experience, the reliability of their solutions, service availability, or the ability to keep their platform up to date.

The added value that a PDP can offer in key aspects such as system integration, processing large volumes of invoices, or deploying complementary solutions to streamline the invoice lifecycle management will be crucial in choosing one PDP over another.

White Paper on e-Invoicing

The French e-Invoicing and e-Reporting model in detail.

Download the White paper now. Stay permanently updated on the evolution of the e-Invoicing and e-Reporting system in France.

Funcionality of the Partner Dematerialization Platform (PDP)

A Partner Dematerialization Platform (PDP) is a technological provider that allows companies to manage their electronic invoicing in France without going through the country's public invoice portal (PPF).

PDPs, after successfully completing a certification process by the DGFiP called "inmatriculation," demonstrate their ability to guarantee security and quality throughout the electronic invoice exchange process according to the standards required by the French government.

The PDP acts as an intermediary between the sender and the recipient, ensuring the authenticity, integrity, and confidentiality of the documents.

Among the functions of PDPs are:

Receipt and verification of invoices: The PDP receives invoices in electronic format and verifies their authenticity and legal validity. This includes checking the electronic signature (for invoices that are signed) and compliance with the technical, fiscal, and regulatory requirements defined in current regulations.

Transformation and validation of invoices: The PDP transforms invoices into the required electronic format to comply with electronic data interchange (EDI) standards and fiscal and regulatory requirements. Additionally, it validates the integrity and consistency of the data in the invoice.

Archiving and storage of invoices: The PDP archives electronic invoices and retains them for the time required by tax and accounting legislation. This ensures the integrity and authenticity of the documents and allows access to them in the event of an audit or legal dispute.

Transmission of invoices: After verifying the recipient of the invoice, the PDP assumes its transmission to ensure its correct delivery to the client through the corresponding channel. In the case of invoices destined for clients who use the services of another PDP, they can also be sent in a structured EDI format with more commercial and logistical information than what can be transmitted through minimum baseline formats (Factur-X, UBL, CII).

Requirements to be a PDP (Partner Dematerialization Platform)

Security requirements: It is essential for a PDP provider to have the highest security standards to protect user data and information. PDP providers must comply with security requirements such as the ISO 27001 standard for Information Security Management Systems (ISMS) and SecNumCloud, a French regulation that establishes security requirements for cloud service providers.

Technical capabilities for processing electronic invoices: PDPs must be capable of implementing all the processes required by the French electronic invoicing system. This includes technically validating received data schemas, invoice signatures, the ability to issue advanced electronic signatures, capabilities to securely preserve them for at least 10 years, and more.

Flexibility in the use of formats beyond the minimum baseline: PDP providers must be able to support a wide variety of electronic invoice formats beyond the minimum formats established by French law. This allows issuers and recipients of invoices to exchange basic logistic and commercial information that cannot be exchanged using the "socle minimum" formats.

Extraction and transmission of data according to PPF in one of the specified formats: The PDP provider must allow the extraction and transmission of electronic invoicing data in one of the formats specified by the Portail Public de Facturation (PPF).

Strong authentication for the invoicing platform: PDP providers must ensure that their electronic invoicing solutions are protected with strong authentication, such as two-factor authentication or electronic certificates, to ensure that only authorized users have access to the platform and information.

Electronic invoicing in France will become mandatory.

EDICOM is a candidate to become one of the first PDPs in France.

If your company is affected, don't delay the implementation of your solution. Contact us and we will analyze your specific needs to implement the solution that best suits the characteristics of your company.

Differences between PPF and PDP

In France, the former electronic invoicing portal for public administration, Chorus Pro, has been renamed as the Public Invoice Portal (PPF). All invoices, regardless of whether they are intended for the administration or not, will have to be sent to the PPF for declaration. This includes invoices processed through Partner Dematerialization Platforms (PDPs).

So, what is the difference between PPF and PDP in electronic invoicing in France? In summary, PPF is the centralized public portal for electronic invoicing for all of France, while PDPs are private providers that can be used by companies to send and receive electronic invoices.

If an invoice issuer uses a PDP and their client does not, the PDP will send the invoice to the PPF, and the PPF will take care of sending it to the client. The same applies to receiving invoices.

In the case where both the issuer and recipient use the services of a PDP, the PDPs will be responsible for exchanging invoices between themselves.

The possibility of exchanging invoices directly between customers and suppliers through the PPF exists. Moreover, this can be a free service, as interaction with the Portail Public de Facturation can be done through a web environment deployed by the DGFiP or through integrated EDI or its API.

The limitation in this case is related to the invoice format that can be exchanged via the PPF. Only Factur-X, UBL, or CII formats can be managed. These invoice formats include all the required fiscal information but, in most cases, do not allow for the inclusion of key commercial and logistical information in the reconciliation and management processes of customers and suppliers.

However, using PDPs allows overcoming this limitation. Any type of invoice with all the desired details can be exchanged between PDPs. Moreover, advanced PDPs will have value-added solutions in their platforms that allow for the implementation of complex projects to process large volumes of documents. A reliable PDP will provide advanced tools to integrate their platform with internal management systems, automate multiple processes in both invoice issuance and receipt, and offer value-added solutions such as invoice approval workflow tools or an Electronic Archiving System.

It is expected that companies with higher volumes of invoice issuance and receipt will choose to use PDP services. Companies with lower volumes and less demanding requirements regarding automation or integration with internal systems may opt to exchange invoices directly through the PPF.

Exchange Circuits

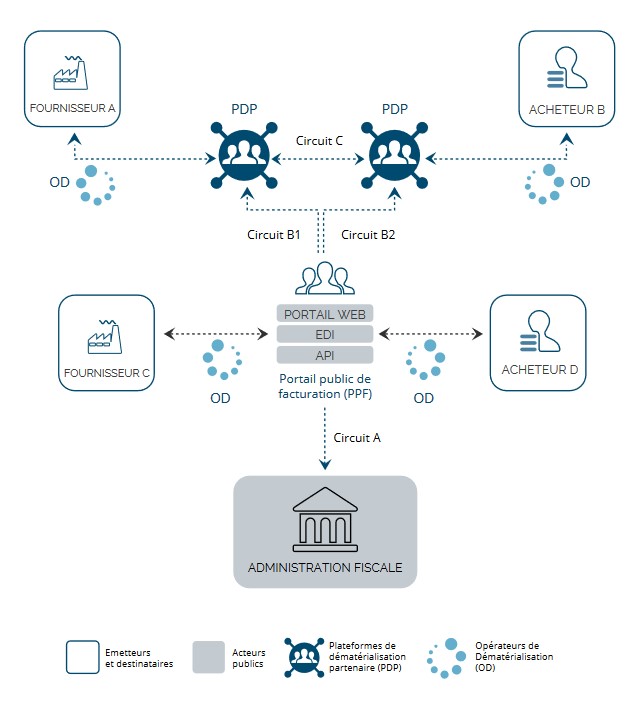

The technical regulations establish three circuits for the exchange of invoices, the communication of billing data, and the transmission of the corresponding lifecycle. These circuits vary depending on whether companies use a Dematerialization Platform (PDP) or not.

One option for exchanging electronic invoices (circuit A) would be through the use of the public invoicing portal (PPF) exclusively, as both the issuer and recipient would use this platform for the exchange.

Circuits B and C consider scenarios in which at least one of the companies involved in the invoice exchange would use the services of a PDP.

Circuits B1 and B2:

Exchange of invoices between a partner using a PDP and another using the PPF.

In these flows, one of the participants in the invoice exchange uses the services of a PDP, while the other exclusively uses the PPF.

When the invoice issuer has a PDP, they will typically generate their invoice. It will be their PDP that, based on the data issued by their management system, recognizes the recipient, thereby identifying that the channel for delivering the invoice should be the Public Invoicing Portal.

The PDP will need to transform the invoice from their client into one of the three structured formats of the "socle minimum" defined by the DGFiP to generate the minimum set of invoice data (UBL, CII, or Factur-X).

To do this, the PDP will validate that it has the necessary minimum information to form an invoice that complies with the current regulations. It will apply the required mechanisms to ensure the integrity and authenticity of the document (electronic signature or alternative methods) and finally deliver it to the PPF, which will be responsible for delivering it to the recipient.

All management regarding the acknowledgments generated by the PPF or the invoice recipient regarding the original invoice will be handled by the PDP, with the client reporting them through deployed technical solutions (lifecycle monitoring solutions, response acknowledgment integration systems, etc.).

When the invoice issuer uses the PPF, it will be the PDP of the recipient that receives the invoice. In this case, after performing the relevant validations, the PDP will act as the hub for all received invoices, delivering them to the client in the agreed-upon form.

Circuit C:

Exchange between two partners using Partner Dematerialization Platforms (PDPs).

In this flow, large companies usually have a greater degree of flexibility in terms of electronic invoice exchange, thanks to Partner Dematerialization Platforms (PDPs) being able to continue using both previously agreed structured formats between companies (such as EDIFACT or XML) and those defined by the DGFiP in the "socle minimum" (such as UBL, CII, or Factur-X).

In this scenario, the invoice provider or issuer exports a file with the necessary data to generate the electronic invoice, which is delivered to the PDP. This platform handles connections with the ERP to integrate the data file, validate it, and transform it into the agreed-upon standard with their business partner (whether it's the socle minimum or another structured format).

Once validated and transformed, the issuer's PDP sends the electronic invoice to the recipient's Dematerialization Platform and sends an extract to the PPF with the billing data required by the DGFiP in one of the three valid formats (UBL, CII, or Factur-X).

The recipient's dematerialization platform performs the corresponding validation checks and ultimately integrates the invoice into the client's management system. Throughout the process, different states are generated that define the invoice's lifecycle and are communicated both between the PDPs and to the DGFiP (for example, the issuer's PDP notifies the DGFiP of invoice collection, just as the recipient's PDP notifies its payment).

What is the "Annuaire"?

To determine whether the buyer uses the public invoicing portal (circuit A or B) or an associated dematerialization platform (circuit B or C), Scheme Y requires the creation of a directory (Annuaire) to identify the platform chosen by each invoice recipient.

The Annuaire is a centralized registry of companies managed by the Agence pour l'Informatique

Companies will be identified in this directory through unique identifiers, with the aim of facilitating the exchange of electronic invoices between companies. This directory will enable interoperability among all stakeholders by specifying the platform used in the context of electronic invoicing, as well as the necessary information for addressing and routing invoices. In this way, more efficient and transparent communication is ensured in the process of electronic invoicing between companies.

The Annuaire contains several categories of information:

Identification of invoice recipient companies, including details of the organizational structure for invoice management within each company (SIREN, SIRET, routing code).

Identification and interoperability among dematerialization platforms for receiving electronic invoices and their validation period.

Additional data related to B2G exchanges and proper routing of B2B invoices.

All companies using electronic invoicing in France are required to register in the Annuaire. By registering, companies ensure that their electronic invoices are sent correctly and processed efficiently, which helps reduce errors and delays in the invoicing process, and comply with tax and legal obligations regarding electronic invoicing in France.

Advantages of using a PDP

Companies that choose to send and receive their electronic invoices through a Plateforme Dématerialisation Partenaire (Partner Dematerialization Platform) will have greater capabilities and value-added services depending on the electronic invoicing service provider.

These are some of the benefits that PDPs generally offer to taxpayers who choose to use them:

- Security: Providers wishing to be accredited as a PDP must demonstrate significant security measures, possess ISO27001 accreditation, and have proprietary data centers (or SECNUMCLOUD certification in its absence).

- Periodic audits: PDPs will undergo periodic audits by independent entities to ensure that their operating conditions as platforms remain valid over time.

- Interconnection: PDPs will be interconnected to facilitate immediate exchange of invoices among themselves and with the PPF.

- Multiple formats: While invoices sent directly to the PPF only support one of the 3 fiscal formats of the socle minimum, using a PDP allows for the use of other formats such as EDIFACT, thus maintaining existing invoice flows between clients and suppliers.

In the specific case of the advantages offered by a PDP Candidate like EDICOM, in addition to the general ones just listed, the following should be highlighted:

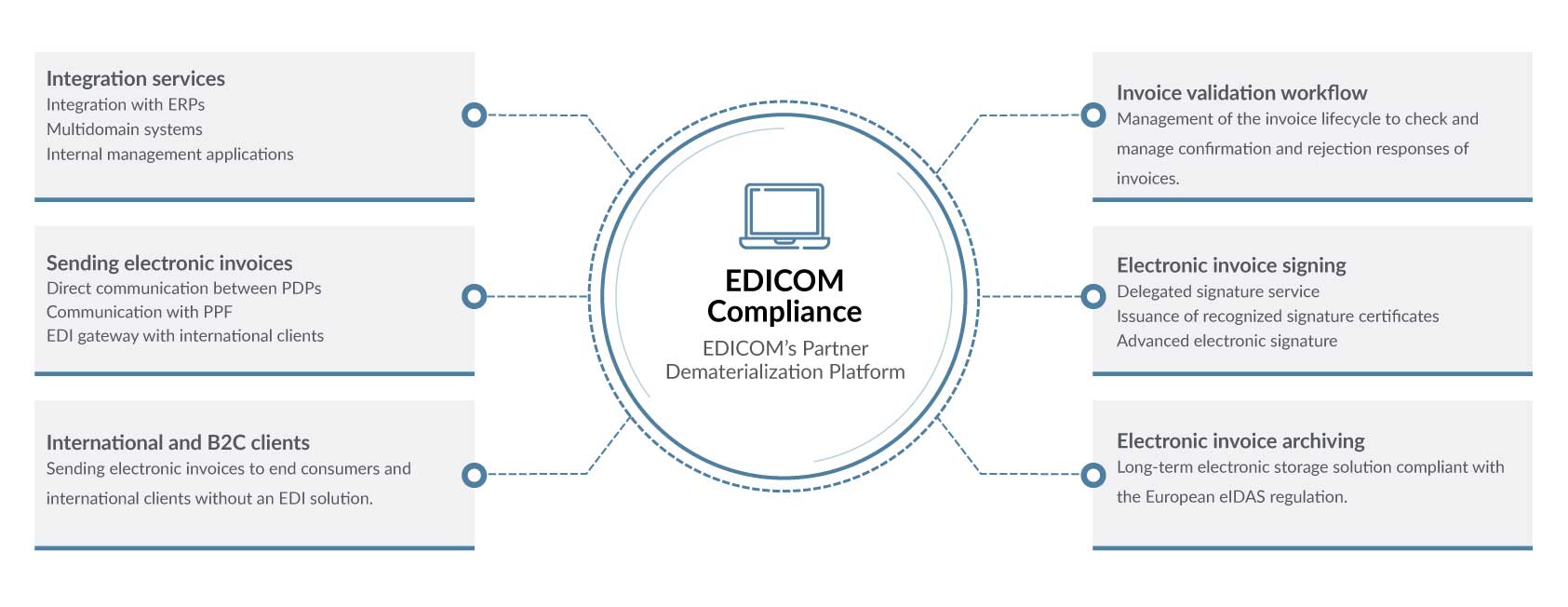

- Technical capacity: EDICOM is an EDI and Electronic Invoicing provider with extensive experience and proprietary developments. Our capabilities simplify the processing of large volumes of information, integration with any management system, and the deployment of specific communication systems such as AS4, to offer the highest levels of security and traceability in integration with the PPF.

- eIDAS Qualified Signature Services: We are qualified providers of trusted services for the provision of qualified electronic signature services, as established by the eIDAS regulation. We apply electronic signatures to the invoices we issue and automatically validate the signature of received invoices to provide maximum guarantees to our customers and users.

- eIDAS Long-Term Archiving: We offer an Electronic Archiving System (System d’Archivage Éléctronique) accredited by the eIDAS regulation to preserve issued and received invoices, along with the acknowledgments that form part of their life cycle.

- High availability: Our SLA guarantees a service availability of 99.9%.

- Human-assisted customer support: We have a customer support center with specialized technicians who personally handle incidents and inquiries, and provide 24x7 support to address critical processes.

Do you have questions about the electronic invoicing system in France?

Should you hire the services of a PDP?

Contact us and we will analyze your company profile to design a solution adapted to your needs.

EDICOM’s Partner Dematerialization Platform

EDICOM, one of the main international references in electronic invoice solutions, is a candidate to become one of the first PDPs for France.

We have important international accreditations in information security, we are one of the largest providers of EDI solutions in the market, and we have a long experience in electronic data interchange systems and international electronic invoicing since 1995.

Our data integration services, invoice validation, electronic signature, as well as our solutions for designing invoice approval workflows or long-term storage, probably make us the PDP candidate with the most advanced platform in the market.

eIDAS PDP

EDICOM is a qualified trust service provider in accordance with the European eIDAS regulation.

This recognition offers great added value to the market. Once EDICOM is accredited as a Plateforme Dematerialisation Partenarie, it will most likely become the first eIDAS PDP in France.

The eIDAS regulation harmonizes the mechanisms to be used by service providers in the European Union for electronic signature and data encryption.

EDICOM has different solutions accredited by the eIDAS regulation that can be key for the services of issuing and receiving electronic invoices:

- Advanced electronic signature services for ensuring the integrity and authenticity of documents according to the current regulations in Europe for electronic invoicing. Through this service, EDICOM can sign the invoices issued by its clients using recognized certificates and secure signature creation devices.

- Issuance of recognized certificates: When necessary, EDICOM can issue recognized certificates on behalf of the sender of the electronic invoices.

- Electronic Archiving System: Long-term storage service audited in accordance with the eIDAS regulation to preserve the integrity of issued and received invoices over time.

Partner Dematerialization Platform (PDP) - FAQ’s

What are the functions and responsibilities of a PDP?

The main functions and responsibilities of a PDP in France are to receive, validate, archive, and transmit electronic invoices to the corresponding recipients, as well as to ensure their authenticity, integrity, legibility, and preservation for a minimum period of ten years.

What technical requirements must a PDP fulfill in France?

Among the technical requirements that a PDP must fulfill in France are: ensuring the authenticity, integrity, legibility, and preservation of electronic invoices, having adequate security measures to prevent unauthorized access, being able to process large volumes of electronic invoices, and having a technical solution compatible with the information systems of its clients.

Is a PDP required to validate the electronic signatures of received invoices?

Yes. The electronic signature is one of the mechanisms provided in the electronic invoicing model to ensure the integrity of the document. It is not the only one, but it is by far the one that provides the greatest guarantees for this purpose. Therefore, any invoice received by a PDP that is signed at the source must be validated, which implies that 100% of the PDPs must have solutions that allow them to meet this requirement.

What happens if a PDP fails to fulfill its obligations?

If a PDP fails to fulfill its obligations, it may be subject to administrative and/or criminal penalties, in addition to possible suspension or cancellation of its registration as a PDP.

What is the retention period for electronic invoices issued by a PDP?

The retention period for electronic invoices issued by a PDP is ten years from the date of issuance of the invoice.